Tax Exemptions For Healthcare Workers . for the 2023 tax year, if you paid a caregiver $2,600 or more, then you are required to withhold and pay medicare and social. the employer may not owe employment taxes even though the employer needs to report the caregiver's. fortunately, you’ll find some light at the end of the tax year: Federal tax credits and deductions that apply directly or indirectly to caregiving. claim or report coverage exemptions on form 8965, health coverage exemptions pdf, and file it with form 1040, form 1040. nurses, midwives, and other healthcare professionals can deduct expenses related to professional memberships from their.

from www.sampleforms.com

fortunately, you’ll find some light at the end of the tax year: claim or report coverage exemptions on form 8965, health coverage exemptions pdf, and file it with form 1040, form 1040. the employer may not owe employment taxes even though the employer needs to report the caregiver's. for the 2023 tax year, if you paid a caregiver $2,600 or more, then you are required to withhold and pay medicare and social. Federal tax credits and deductions that apply directly or indirectly to caregiving. nurses, midwives, and other healthcare professionals can deduct expenses related to professional memberships from their.

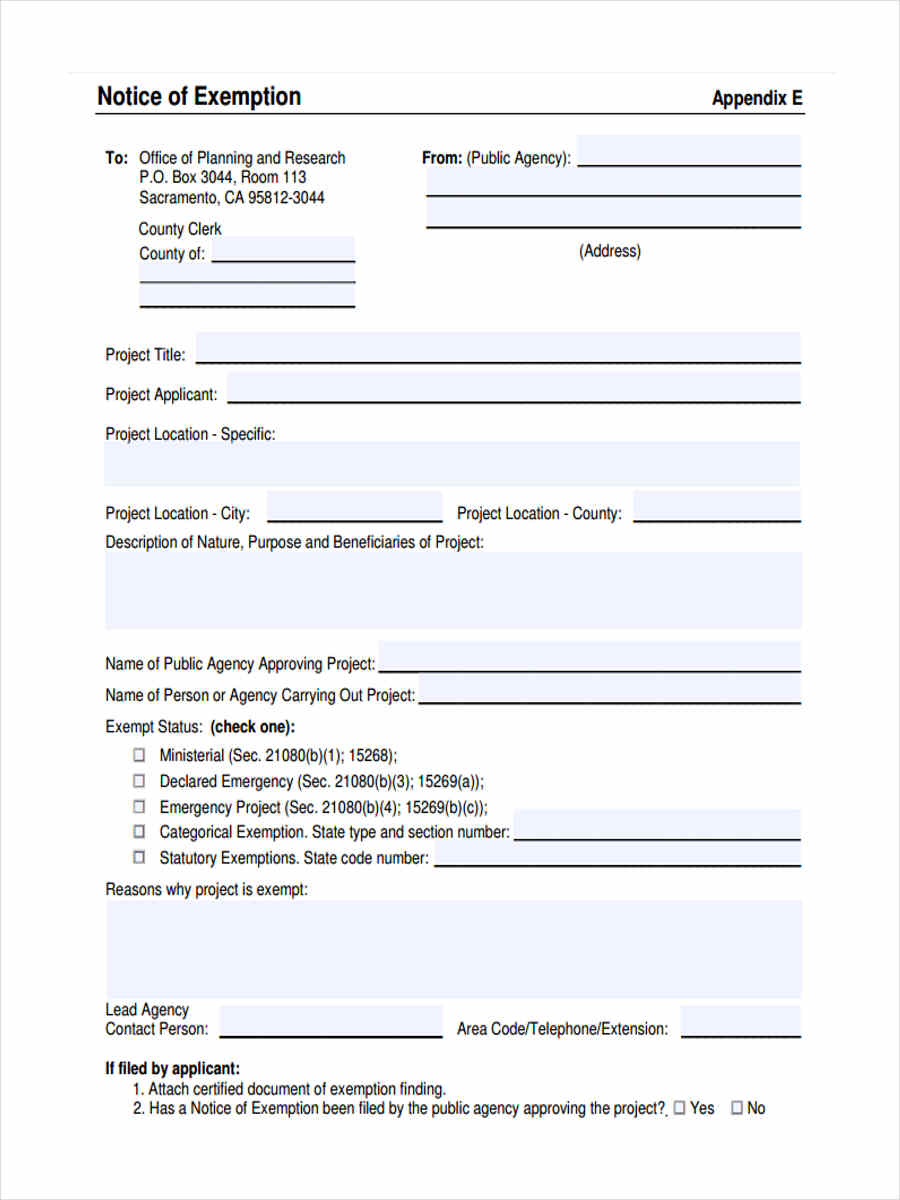

FREE 6+ Sample Notice of Exemption Forms in MS Word PDF Excel

Tax Exemptions For Healthcare Workers claim or report coverage exemptions on form 8965, health coverage exemptions pdf, and file it with form 1040, form 1040. the employer may not owe employment taxes even though the employer needs to report the caregiver's. Federal tax credits and deductions that apply directly or indirectly to caregiving. claim or report coverage exemptions on form 8965, health coverage exemptions pdf, and file it with form 1040, form 1040. nurses, midwives, and other healthcare professionals can deduct expenses related to professional memberships from their. fortunately, you’ll find some light at the end of the tax year: for the 2023 tax year, if you paid a caregiver $2,600 or more, then you are required to withhold and pay medicare and social.

From myinvestbuddy.com

Ultimate Guide for TAX Exemptions & Deductions My Invest Buddy Tax Exemptions For Healthcare Workers for the 2023 tax year, if you paid a caregiver $2,600 or more, then you are required to withhold and pay medicare and social. the employer may not owe employment taxes even though the employer needs to report the caregiver's. nurses, midwives, and other healthcare professionals can deduct expenses related to professional memberships from their. fortunately,. Tax Exemptions For Healthcare Workers.

From hub.universalhealthct.org

Am I Eligible for an Exemption Under the Affordable Care Act? Universal Health Care Foundation Tax Exemptions For Healthcare Workers fortunately, you’ll find some light at the end of the tax year: Federal tax credits and deductions that apply directly or indirectly to caregiving. claim or report coverage exemptions on form 8965, health coverage exemptions pdf, and file it with form 1040, form 1040. for the 2023 tax year, if you paid a caregiver $2,600 or more,. Tax Exemptions For Healthcare Workers.

From www.aotax.com

Health coverage and tax exemptions. Tax Exemptions For Healthcare Workers nurses, midwives, and other healthcare professionals can deduct expenses related to professional memberships from their. fortunately, you’ll find some light at the end of the tax year: Federal tax credits and deductions that apply directly or indirectly to caregiving. for the 2023 tax year, if you paid a caregiver $2,600 or more, then you are required to. Tax Exemptions For Healthcare Workers.

From numerise.com.cy

Exemption from paying increased General Healthcare System Contributions for a period of three Tax Exemptions For Healthcare Workers fortunately, you’ll find some light at the end of the tax year: Federal tax credits and deductions that apply directly or indirectly to caregiving. for the 2023 tax year, if you paid a caregiver $2,600 or more, then you are required to withhold and pay medicare and social. claim or report coverage exemptions on form 8965, health. Tax Exemptions For Healthcare Workers.

From www.exemptform.com

FREE 8 Sample Tax Exemption Forms In PDF MS Word Tax Exemptions For Healthcare Workers the employer may not owe employment taxes even though the employer needs to report the caregiver's. fortunately, you’ll find some light at the end of the tax year: for the 2023 tax year, if you paid a caregiver $2,600 or more, then you are required to withhold and pay medicare and social. nurses, midwives, and other. Tax Exemptions For Healthcare Workers.

From 1sthcc.com

Infographic The Families First Coronavirus Response Act and Exemptions for Healthcare First Tax Exemptions For Healthcare Workers the employer may not owe employment taxes even though the employer needs to report the caregiver's. for the 2023 tax year, if you paid a caregiver $2,600 or more, then you are required to withhold and pay medicare and social. nurses, midwives, and other healthcare professionals can deduct expenses related to professional memberships from their. Federal tax. Tax Exemptions For Healthcare Workers.

From steveneburns.com

Tax and Financial Strategies and Information Helpful forms file your federal tax return FREE Tax Exemptions For Healthcare Workers Federal tax credits and deductions that apply directly or indirectly to caregiving. nurses, midwives, and other healthcare professionals can deduct expenses related to professional memberships from their. for the 2023 tax year, if you paid a caregiver $2,600 or more, then you are required to withhold and pay medicare and social. claim or report coverage exemptions on. Tax Exemptions For Healthcare Workers.

From www.king5.com

Workers eligible for WA Cares exemptions must apply Tax Exemptions For Healthcare Workers Federal tax credits and deductions that apply directly or indirectly to caregiving. fortunately, you’ll find some light at the end of the tax year: for the 2023 tax year, if you paid a caregiver $2,600 or more, then you are required to withhold and pay medicare and social. claim or report coverage exemptions on form 8965, health. Tax Exemptions For Healthcare Workers.

From www.dochub.com

Pa tax exempt form pdf Fill out & sign online DocHub Tax Exemptions For Healthcare Workers fortunately, you’ll find some light at the end of the tax year: for the 2023 tax year, if you paid a caregiver $2,600 or more, then you are required to withhold and pay medicare and social. nurses, midwives, and other healthcare professionals can deduct expenses related to professional memberships from their. the employer may not owe. Tax Exemptions For Healthcare Workers.

From www.formsbank.com

Fillable Form 8965, Health Coverage Exemptions printable pdf download Tax Exemptions For Healthcare Workers the employer may not owe employment taxes even though the employer needs to report the caregiver's. for the 2023 tax year, if you paid a caregiver $2,600 or more, then you are required to withhold and pay medicare and social. Federal tax credits and deductions that apply directly or indirectly to caregiving. nurses, midwives, and other healthcare. Tax Exemptions For Healthcare Workers.

From www.signnow.com

Sample Letter Tax Exemption Complete with ease airSlate SignNow Tax Exemptions For Healthcare Workers for the 2023 tax year, if you paid a caregiver $2,600 or more, then you are required to withhold and pay medicare and social. nurses, midwives, and other healthcare professionals can deduct expenses related to professional memberships from their. Federal tax credits and deductions that apply directly or indirectly to caregiving. the employer may not owe employment. Tax Exemptions For Healthcare Workers.

From aghlc.com

AGH Health Care Tax Credit Is Your Business Eligible? Tax Exemptions For Healthcare Workers nurses, midwives, and other healthcare professionals can deduct expenses related to professional memberships from their. Federal tax credits and deductions that apply directly or indirectly to caregiving. the employer may not owe employment taxes even though the employer needs to report the caregiver's. fortunately, you’ll find some light at the end of the tax year: claim. Tax Exemptions For Healthcare Workers.

From printablelistcasteel.z13.web.core.windows.net

Printable Tax Deduction Cheat Sheet Tax Exemptions For Healthcare Workers for the 2023 tax year, if you paid a caregiver $2,600 or more, then you are required to withhold and pay medicare and social. claim or report coverage exemptions on form 8965, health coverage exemptions pdf, and file it with form 1040, form 1040. nurses, midwives, and other healthcare professionals can deduct expenses related to professional memberships. Tax Exemptions For Healthcare Workers.

From www.dochub.com

Tax exempt form Fill out & sign online DocHub Tax Exemptions For Healthcare Workers nurses, midwives, and other healthcare professionals can deduct expenses related to professional memberships from their. claim or report coverage exemptions on form 8965, health coverage exemptions pdf, and file it with form 1040, form 1040. the employer may not owe employment taxes even though the employer needs to report the caregiver's. Federal tax credits and deductions that. Tax Exemptions For Healthcare Workers.

From www.10news.com

Hundreds of healthcare workers file vaccine religious exemptions Tax Exemptions For Healthcare Workers Federal tax credits and deductions that apply directly or indirectly to caregiving. claim or report coverage exemptions on form 8965, health coverage exemptions pdf, and file it with form 1040, form 1040. fortunately, you’ll find some light at the end of the tax year: nurses, midwives, and other healthcare professionals can deduct expenses related to professional memberships. Tax Exemptions For Healthcare Workers.

From taxcognition.com

Tax Withholding Exemptions Explained Top FAQs of Tax Jan2023 Tax Exemptions For Healthcare Workers Federal tax credits and deductions that apply directly or indirectly to caregiving. for the 2023 tax year, if you paid a caregiver $2,600 or more, then you are required to withhold and pay medicare and social. nurses, midwives, and other healthcare professionals can deduct expenses related to professional memberships from their. claim or report coverage exemptions on. Tax Exemptions For Healthcare Workers.

From www.jpm.law

Capital Gains Tax and Tax Exemptions JPM & Partners Tax Exemptions For Healthcare Workers claim or report coverage exemptions on form 8965, health coverage exemptions pdf, and file it with form 1040, form 1040. the employer may not owe employment taxes even though the employer needs to report the caregiver's. nurses, midwives, and other healthcare professionals can deduct expenses related to professional memberships from their. for the 2023 tax year,. Tax Exemptions For Healthcare Workers.

From peninsulas.vaems.org

IRS Tax Exemption Letter Peninsulas EMS Council Tax Exemptions For Healthcare Workers fortunately, you’ll find some light at the end of the tax year: Federal tax credits and deductions that apply directly or indirectly to caregiving. nurses, midwives, and other healthcare professionals can deduct expenses related to professional memberships from their. claim or report coverage exemptions on form 8965, health coverage exemptions pdf, and file it with form 1040,. Tax Exemptions For Healthcare Workers.